Babies are expensive but they don’t have to break the bank or force you to pick up a second job. Learn how to avoid breaking your budget when your little one joins your family.

It’s no secret that babies and kids are expensive. From doctor visits to possibly missing time at work, the costs begin long before you even get to meet your precious little one.

According to a study done by Health Affairs in January 2020, the average out-of-pocket cost for maternity care with employer-based health insurance was $4,300 assuming there are no complications. If you are high risk or run into problems, these costs can skyrocket. These costs can rarely be lowered, however, so it’s important to control the ones you can.

Knowing which costs you can control and which you can’t is important to staying on track and not getting in over your head financially. You also need to look at your budget and see what you can realistically afford. Don’t forget to factor in maternity leave especially if it’s unpaid. You’ll want to have a buffer built in in case something happens and you need a C-section. I fully intended to go straight back to work a week or two after having my son but knew that if I needed a C-section or something went wrong, it could be 6 weeks or more. Working for a small company, any time off is unpaid so we needed to have the equivalent of my possible lost wages saved up.

The largest and easiest costs to control are baby gear, feeding, and childcare so these are the ones you should focus on. In this post, I’ll give you tips to keep costs low so you can stick within your budget.

Baby Stuff

Every new mom wants to have the best stuff for her little one but that doesn’t mean you have to break the bank and go into debt to do so. Ask yourself if you really need the $500 stroller or if the $120 one will work just as well even if it’s not the exact color you love. Another option is to check for the one you really have to have on Facebook Marketplace or in a local mom group. Many times, you can find almost new condition items for a fraction of their original cost. This works for most baby items including strollers, playpens, clothes, and shoes (they will only fit those tiny Jordans for a few weeks so no need to spring for the full-priced version!). The only item you really should be sure to buy new is your car seat. Buying a second-hand car seat is risky because you never know how they were used or what it may have been through prior to coming into your possession. You don’t want to discover that it was damaged when you get into a wreck and the seat malfunctions, not protecting your child.

Another good way to cover these costs is to register for the items you know you’ll need so that friends and relatives can get them for you. Even if you don’t have someone to throw you a baby shower, chances are people will ask what they can get you for your new addition. Have a registry ready and include a wide range of items on it (onesie sets all the way to that crib you love) so that people don’t feel like they are stuck getting you an expensive gift or nothing. Gift cards to Amazon are a great thing to register for so you can pool funds to get something you really need.

The last way to help lower the cost of all that baby gear is to buy it ahead of time. Before we even got pregnant, we had a jogging stroller that I’d found on clearance years before. There were toys in the closet and baby books waiting that I’d picked up over the years. Worst case scenario, we’d end up donating it someday if we’d never had our son. The best case was that we didn’t have to buy it at the same time we had to get everything else.

Feeding

Feeding your baby will cost a lot more than you ever thought it could, especially if you are either forced to or decide to formula feed. Not only will you need to buy bottles and nipples, but some of the specialty formulas can get very pricey if your child can’t handle the standard stuff, and even the standard stuff isn’t cheap. For example, my son ate Enfamil NeuroPro. He went through a large canister (20.7 oz) every 6 days. At our local Meijer store, they are $28 each. That’s an additional $140 each month if he was fed only formula. Considering our food budget was $200-$400 a month prior to having him, that’s a good increase. Had he needed Nutramigen, that would have been well over $200 a month alone. While you can’t feed your child less or feed a cheaper formula their stomach can’t handle, you can still lower your feeding costs in a number of ways.

The first would be to breastfeed. The American Academy of Pediatrics (AAP) recommends exclusively breastfeeding for the first 6 months for several reasons for both mother and child. While breastfeeding, you will need to consume more calories but the cost is nowhere near that of feeding formula. That being said, breastfeeding is not easy and not everyone is able to. If you’re unable to breastfeed, that doesn’t make you any less of a mom.

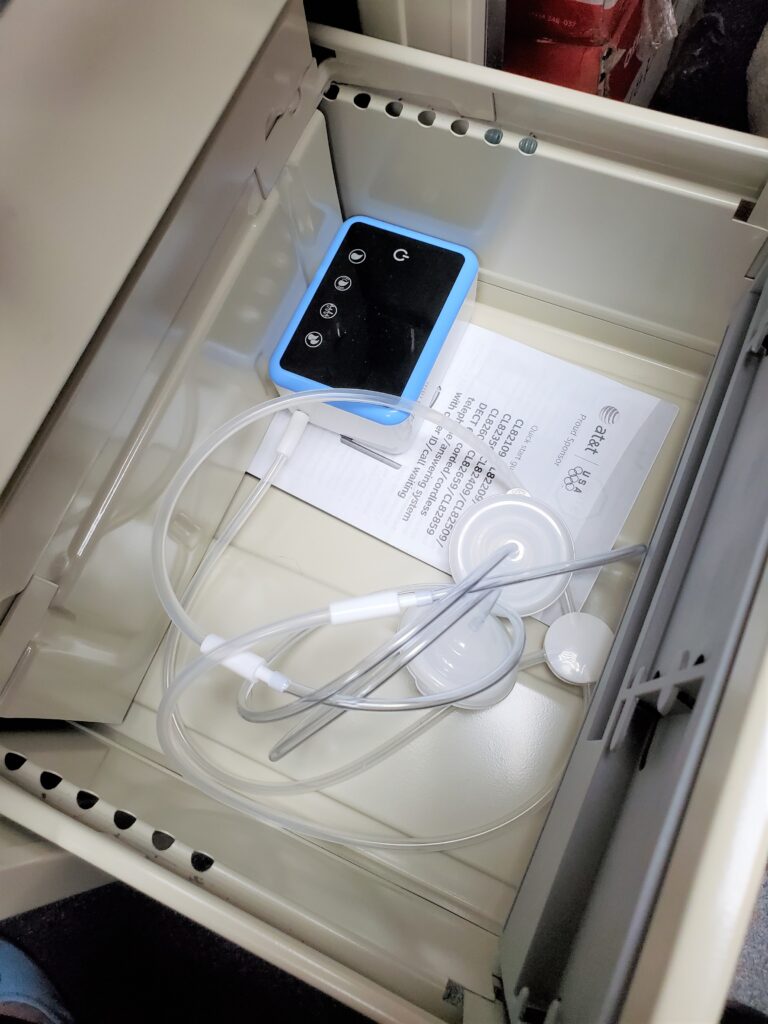

The second option would be to exclusively pump or supplement feed (breast milk and formula). I exclusively pumped and supplemented with formula for the first 7 months of my son’s life. It saved us a lot of money on formula (1 can versus 5 a month) and while exclusively pumping has its own costs, they are still less than formula. The investment tradeoff here is time and convenience.

The third way would be to both buy in bulk and take advantage of coupon/discount programs the formula companies offer. Every couple of months, Enfamil and Similac sent me coupons for $5-$10 off cans of their formula. The ones that I didn’t use, I offered to moms who did use that type. It’s a free way to cut your costs and even if $5 doesn’t seem like much, that’s lunch, another onesie, or a drink at Starbucks for those mornings when you feel like all you do is laundry, clean, and feed a tiny dictator!

Childcare

Childcare is one of the most costly parts of having a baby. If you’re like most moms, you’ll be looking at returning to work after your maternity leave and if you haven’t already, you should start finding out what childcare in your area costs since it varies highly by area. Home daycares are generally less expensive than daycare centers. They are also less regulated than the larger daycare centers. In our area, daycare starts at around $225 a week for infants. We didn’t have that room in our budget so we needed to find an alternative.

Having family help by watching your baby while you work is one common option. Not only does it lower or remove the cost of childcare but it also allows your baby to bond with family members they may not otherwise see a lot. Keep in mind that this also changes the relationship with grandparents taking care of them a bit as they take on a more parental role than a grandparent role in this situation. The other drawback is that it leaves you few options if your caregiver gets sick or isn’t available for some reason.

Another option would be to work from home or see if you can take your baby to work with you. Taking my son to work with me is what I ended up doing because we don’t have family nearby able to watch him and my job isn’t able to be remote. This isn’t an option for all moms, but if you work at a small company or have an office-based job that could be done from home, it’s worth investigating. Having your baby with you while you work can be extremely rewarding but beware, it comes with its own set of challenges since you need to still be able to do your job while caring for your child. It is definitely not for the faint of heart, no matter how much it may save you!

Conclusion:

Once you identify where you can cut costs, stick to that and remember that it will be worth it to be financially stable down the road. Besides, with the money you save, maybe you can take a dream vacation with your little one once they are a bit older. Memories last a lifetime. Baby Jordans don’t.

Do you have any great cost-cutting tips? If so, please share them in the comments below!